While studying in the US, Priyanka Kanwar, Co-founder at Falcon, knew that she had to start a business in India. In an older interview with the Scatter Brain, she confessed how her father and grandfather ignited the fire inside her to build something of her own.

Cut to today, she has changed the world of fintech by making the transfer of money seamless. HerZindagi, in association with Jagran New Media, organised the WomenPreneur Award on February 23, and Kanwar won the Fintech Entrepreneur of the Year award.

Kanwar’s initial plans were to go to England and complete her graduation from Oxford or Cambridge. However, she took a year’s break after her grandfather’s demise and travelled across India to film a documentary on microfinance. She cherished the experience of photography, filmmaking and creative work.

While studying at Yale, she took up different courses, including environmental engineering, physics and music. However, she was still doing the same thing as everyone on the campus.

She started taking MBA classes during her undergraduate. She became obsessed with starting something of her own, a mobile payment startup in India. She ended up creating Kite Cash, which was somewhat similar to MPesa - a mobile phone-based money transfer service. She started it with Prabhtej Bhatia.

It aimed at making money (tax-saving options) transfers via phone seamless while extending its services to rural parts of the country as well. It included building trust with her customer base so that they could feel comfortable using the platform for transactions.

What she created for students, housewives and people living in tier-2 cities in India, slowly grew into a huge platform which everyone wanted to use.

Don't Miss: 5 'Gold' Investments Women Must Know About

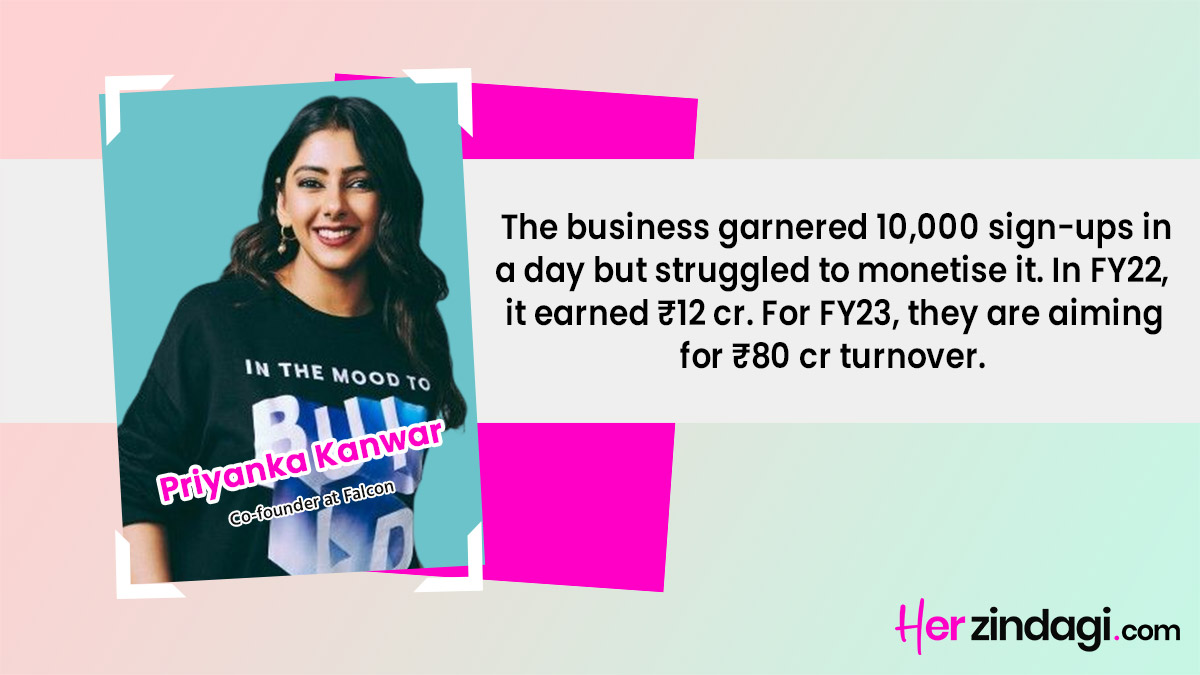

Kanwar attended Delhi University to conduct a beta test of Kite. In just one day, the application had 10,000 sign-ups. Within eight months, it had crossed the 1.5 lakh mark for the sign-ups and had people from over 2,000 cities in India using the application (how to use WhatsApp on your laptop).

Though the application was able to garner more popularity by the day, Kanwar and Bhatia decided to take it to the next level and make it more profitable. They converted it into a B2B (business-to-business) model.

Don't Miss: How Women Can Buy A Car

Kite became Falcon and now has tie-ups with Visa, Yes Bank, ICICI Bank, Punjab National Bank, NPCI and Visa among others. The list of angel investors includes Licious, Sila Money, Silicon Valley Bank and Facebook among others. In the financial year 2022, the business earned ₹12 crores. For FY 2023, they are aiming for ₹80 crore turnover.

Also watch this video

Herzindagi video

Our aim is to provide accurate, safe and expert verified information through our articles and social media handles. The remedies, advice and tips mentioned here are for general information only. Please consult your expert before trying any kind of health, beauty, life hacks or astrology related tips. For any feedback or complaint, contact us at compliant_gro@jagrannewmedia.com.